FICO 9 Credit Score

The Fair Isaac Corporation (FICO) has changed the way in which they calculate your credit score. The new credit scoring system, called FICO 9 Credit Score, is a tongue twister. It went into effect in 2014. However, it wasn’t until banks starting using the new score in mass that Fair Isaac made the new formula available to consumers. FICO is the most widely used credit score in the country. 90% of all credit lenders (whether they are selling mortgages, credit cards, personal loans, and more) use the FICO score in some way.

The Fair Isaac Corporation (FICO) has changed the way in which they calculate your credit score. The new credit scoring system, called FICO 9 Credit Score, is a tongue twister. It went into effect in 2014. However, it wasn’t until banks starting using the new score in mass that Fair Isaac made the new formula available to consumers. FICO is the most widely used credit score in the country. 90% of all credit lenders (whether they are selling mortgages, credit cards, personal loans, and more) use the FICO score in some way.

Consumer advocates have long been pushing to make credit scoring models a snap for people who have debt in collections or medical debt. More than 64 million Americans have some kind of medical collection record on their credit reports, according to Experian. Collection agencies report a whopping 99.4% of medical debts dragging down people’s credit health in the process.

The new Fico 9 Credit Score treats medical collections differently than non-medical collections, like credit cards. All in all, your credit score will be less damaged by a medical debt you can’t afford to pay than it would be damaged by, say, that Macy’s card payment you fell behind on.”

What are FICO 9 credit scores?

Caroline Mayer, consumer blogger says, “It’s an algorithm designed to predict your likelihood of repaying debt. Lenders use your score to determine whether to approve you for loans and credit cards and at what interest rates. Insurers use credit scores to set premium rates, and employers use them when making hiring decisions.

FICO credit scores run from 300, considered the highest risk of default, to 850, the lowest risk. Though FHA for years has accepted applicants who have FICO scores in the 500s, the practical reality has been that most lenders ignore borrowers whose scores are under 620 or even 640.

How are FICO 9 credit scores calculated?

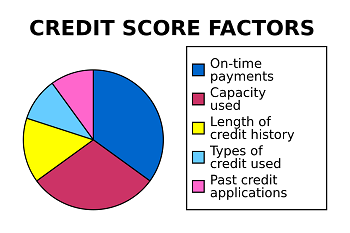

Here in Kansas City, your score is based on many different pieces of credit data in your credit report. This data is grouped into five categories as outlined in the image on the right. The percentages in the chart reflect the importance of the categories in determining how the calculations affect your FICO 9 Credit Score.

If you don’t know your FICO 9 Credit Score, you can request a free copy of your credit report then check it for errors, such as late payments incorrectly listed for any of your accounts and that the amounts owed for each of your open accounts is correct. If you find errors on any of your reports, dispute them with the credit bureau.

Forbes says to be careful with some consumer sites offering free credit reports. “The new free scores from consumer sites are often “ballparks,” not the ones used by financial institutions to determine credit. Even more confusing, your FICO credit score or Vantage score may differ from lender to lender, since each institution can tinker with the parameters.

Some use scores created by FICO. Others use VantageScore, developed by credit rating bureaus Experian, Equifax and TransUnion. Still others compute scores by working with a single credit bureau. FICO and TransUnion’s New Account Score ranges from 300 to 850; Vantage, from 501 to 990; Equifax’s is between 280 and 850 and Experian is 330 to 830.

Got a Low FICO 9 Credit Score?

Making your credit payments on time is one of the biggest contributing factors to your FICO 9 Credit Score. Set up reminders like knotted strings on your fingers for making payments or switch from paying by check to automatic bank debits to each creditor.

Get out of debt. Reducing the amount that you owe is going to be a far more satisfying achievement than improving your credit score. The first thing you need to do is stop using your credit cards. Yes, you’ll probably hiss at this recommendation. Come up with a payment plan that pays off the cards. Once you pay off your credit card debt, focus on building an emergency fund equal to six months living expenses. Finally, save large amounts of money going to interest by paying off your mortgage early.

If you are ready to make the leap to owning a home and you have a low FICO 9 Credit Score, shop around. You may get turned down by some lenders because they haven’t reduced their standards yet. Keep shopping until you find one that has. You are likely to find a better reception than you expected.

The best advice for rebuilding credit is to manage it responsibly over time. If you haven’t done that, then you need to repair your credit history before you see credit score improvement.

Terra Firma Property Solutions, LLC is a professional, full-service real estate solutions firm.

We buy and sell properties throughout the greater Kansas City area. We specialize in buying distressed homes, then renovating and reselling them to home buyers and landlords. Terra Firma Property Solutions is excited to be part of the economic rejuvenation of Kansas City and its surrounding areas.

Call us today at (816) 866.0566